Credit Shelter Trust & Marital QTIP Trust | New York Estate Planning Lawyer

Protect Your Family’s Future with a Credit Shelter Trust and Marital QTIP Trust

You may not know that in New York, simply leaving everything to your spouse could waste one spouse’s estate-tax exemption because New York does not allow portability of the exemption between spouses.

Why the Credit Shelter Trust and Marital QTIP Trust Matter

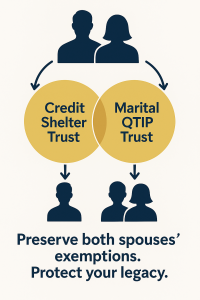

If you’re a married couple with a sizable estate in New York and want to preserve assets for your children while minimizing estate taxes, the strategy of using a Credit Shelter Trust together with a Marital QTIP Trust offers a powerful solution.

The Credit Shelter Trust (also known as a “bypass trust” or “family trust”) is funded with the largest amount that can pass free of federal and New York estate tax based on the first spouse’s exemption. The assets in that trust grow outside of the surviving spouse’s taxable estate, yet the surviving spouse may still receive income (and sometimes principal for health, education, maintenance, and support).

The Marital QTIP Trust (Qualified Terminable Interest Property Trust) receives the remaining estate and qualifies for the unlimited marital deduction under IRC § 2056(b)(7). That means the assets flowing into the QTIP trust at the first death pass to the surviving spouse without immediate estate tax, deferring tax until the second death.

Together, these trusts allow both spouses’ exemption amounts to be fully used, protect assets from estate tax, shield from creditor / remarriage risks, and ensure children or other beneficiaries ultimately receive the assets as intended.

How It Works in New York

-

When spouse A dies: fund the Credit Shelter Trust with an amount up to the New York basic exclusion amount (BEA) under Tax Law Art. 26.

-

The rest of the estate flows into the Marital QTIP Trust, which qualifies for the marital deduction and defers tax until spouse B dies.

-

Upon spouse B’s death: the remaining assets in both trusts pass to the ultimate beneficiaries (for example, children) and the first spouse’s exclusion has already been preserved.

-

Important: In New York the estate tax “cliff” exists – if the estate exceeds 105% of the BEA the full estate is taxed, not just the excess.

-

Also: New York requires a specific QTIP election on the New York estate tax return for decedents dying on or after April 1 2019.

Key Benefits of This Two-Trust Design

-

Maximises exemptions: Ensures both spouses’ New York and federal estate tax exemptions are applied.

-

Defers estate tax: Thanks to the marital deduction, tax is postponed until the second spouse’s death.

-

Protects future generations: Assets designated for children are shielded from being swallowed by taxes or diverted.

-

Creditors & remarriage risk protection: The Credit Shelter Trust keeps assets out of the surviving spouse’s outright control.

-

New York-specific planning: Because New York does not allow exemption portability, this structure becomes especially important.

What to Consider Before Moving Forward

-

Exemption amounts change: The New York BEA was $6,940,000 for deaths in 2024 and $7,160,000 for 2025. NY State Tax Department

-

Trust drafting detail matters: The Credit Shelter Trust and QTIP must be carefully designed so the surviving spouse receives required income interest and the QTIP trust meets IRC § 2056(b)(7) requirements.

-

Administration & trustee obligations: Trusts require active oversight, compliance with tax‐filing rules, and proper distributions.

-

Not just for ultra‐wealthy: Even estates modestly above the BEA can risk the “cliff” effect in New York if the plan isn’t in place.

-

Coordination between states: If you own property outside New York or reside partly outside the state, interplay of other state laws may matter.

-

No substitute for legal advice: This overview does not constitute legal advice.

Why Our Firm Has the Experience to Help you

We have experience in drafting and implementing estate plans for New York residents that utilise Credit Shelter Trusts and Marital QTIP Trusts—so your estate plan works with both federal and New York estate tax rules. We handle the drafting, coordination, trustee wording, tax‐return linkage, and help you evaluate whether this strategy fits your family’s goals.

Next Step

If you’re facing an estate that may be affected by New York’s estate tax rules—or simply want to preserve your assets for the next generation while keeping flexibility—we invite you to reach out. Let’s discuss whether a Credit Shelter Trust and Marital QTIP Trust make sense for your situation.

Call us today at (888) 275-2620 to arrange a consultation.

CLICK HERE to contact the law firm.